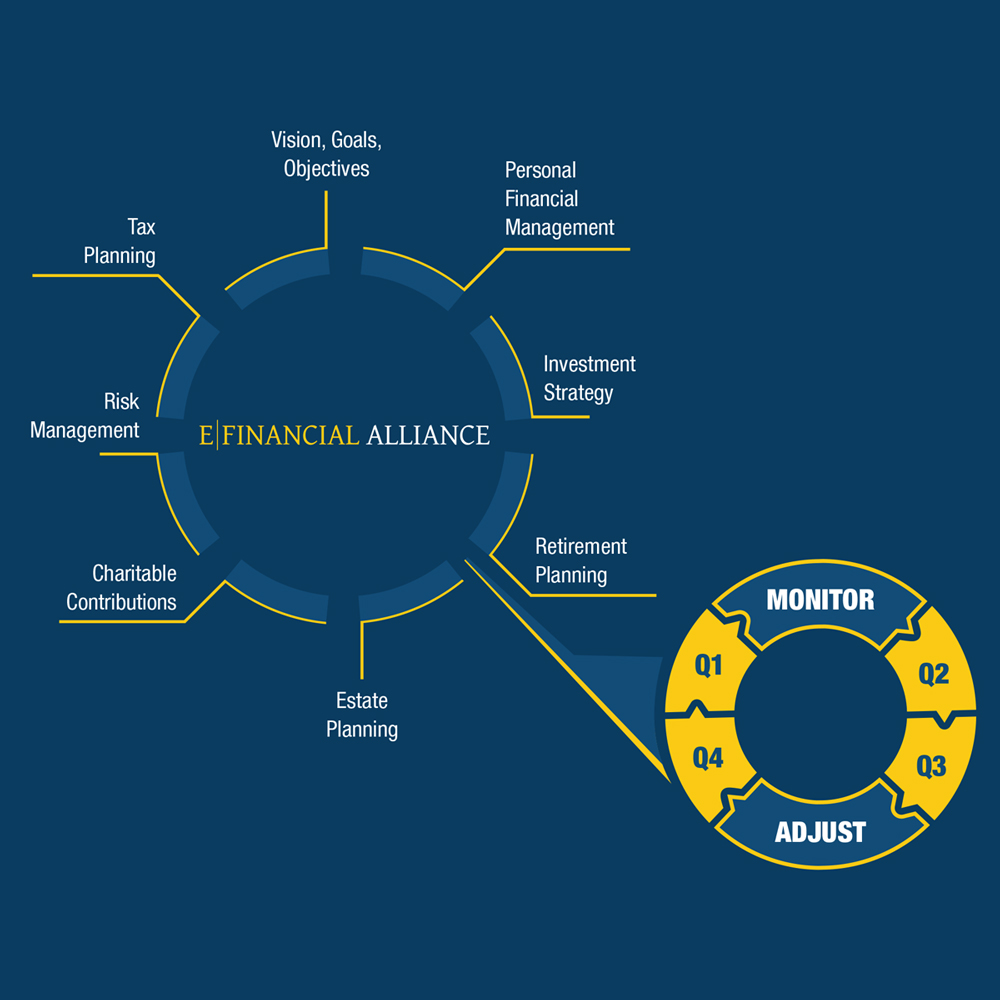

E|Financial Alliance is a fee-only fiduciary and stewardship-focused financial planning and investment firm serving individuals, non-profits, and businesses to help you reach your goals with confidence.

E|Financial Alliance is an investment adviser firm, partnering with professionals in the legal, accounting, and insurance fields to help you manage your finances.